About Certified Cpa

Wiki Article

The Only Guide to Fresno Cpa

Table of ContentsThe Buzz on Accounting FresnoSee This Report about Fresno CpaThe Only Guide for Certified CpaThe Basic Principles Of Accountants The Accounting Fresno Diaries

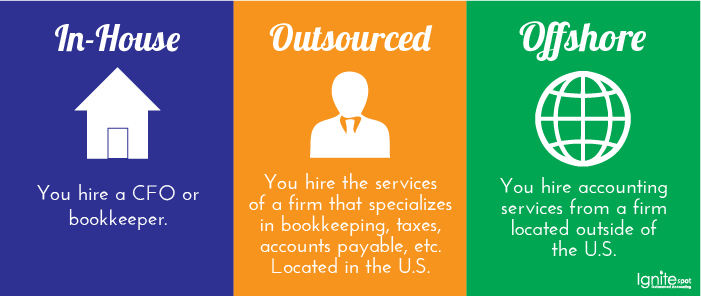

At the end of the month right into recently resolved savings account and a fresh set of financial documents. After your last accounting professional put in their notification. If you discover you may be paying excessive for an internal accounting professional. Outsourcing your accountant can aid you keep your company agile regardless of what economic or social adjustments happen around you.We have all of the experience you're searching for from pay-roll to company development that can aid your company flourish. Emphasis a lot more on boosting your business with excellent client service or advertising and marketing, rather than investing your power on monetary information. Contact a Wilson Doorperson specialist today to start.

CPAs are accounting professionals that are tax specialists. Before you start your company, you ought to meet a CPA for tax obligation guidance on which business structure will conserve you cash and the accountancy technique you should make use of. If you're examined, a certified public accountant can represent you before the IRS.As a small company owner, you may find it hard to determine when to contract out duties or manage them by yourself.

While you can absolutely look after the everyday bookkeeping on your own especially if you have great accounting software application or hire a bookkeeper, there are instances when the experience of a CPA can assist you make sound organization choices, stay clear of pricey mistakes as well as conserve you time. CPAs are tax professionals that can submit your business's tax obligations, solution vital economic questions as well as potentially conserve your service cash.

The Definitive Guide for Accountants

This suggests Certified public accountants are legally required to act in the most effective rate of interest of their customers, whereas a common accounting professional does not have a license to shed. A certified public accountant is also an accounting professional, however just regarding 50% of accountants are likewise accredited Certified public accountants. CPAs can wear lots of hats for your small company.

g., tax documents as well as profit-and-loss statements), economic planning and also tax filing, among various other tasks. They can additionally supply sound financial guidance for your organization as you remain to grow, so you can focus on running your service. These are the general obligations you can anticipate from a CPA: CPAs are qualified to deal with every one of your business tax needs, including year-round recordkeeping as well as declaring tax obligation extensions with the IRS.If you are examined, Certified public accountants can reduce the expense of audit findings by bargaining with the internal revenue service on your behalf.

They can also supply useful recommendations on complex financial issues. CPAs can help check your books and also stop fraudulence., CPAs can establish your service up with a platform that functions for your company.

What Does Certified Accountant Do?

In addition to accounting and also pay-roll, a CPA aids with tax suggestions, planning as well as conformity. The short response is that it depends largely on your company as well as the solutions you require.It's crucial to have a suggestion of the kind of services you need prior to you meet with a potential certified public accountant. In this manner, you can have a clear conversation on how they are going to expense you. By itemizing prices, you can get a realistic concept of just how the certified public accountant could help your organization prosper.

While it's tough to determine a concrete number for just how much you can expect to pay a CPA, it is necessary to have an expertise of regular fees and costs. These are some regular expenses to review before you consult with a CERTIFIED PUBLIC ACCOUNTANT: Per hour rates, Management costs, Documentation fees, Other charges and services The national median wage for a CPA is $40 per hour.

You do not always require to employ a certified public accountant as a full time and even part-time employee to benefit from their knowledge of the ins and outs of business financing, as lots of use their services as experts. These are times you must think about hiring a CPA: When you're releasing a business as well as cash is limited, the concept of paying numerous dollars for a few hours with a CPA might appear elegant.

Accounting Fresno for Dummies

A certified public accountant can assist you establish your company so you can prevent expensive blunders. These are a few of the decisions a certified public accountant can aid you discover this with as you get your service up and also running: CPAs can suggest the very best company framework for your firm. The lawful structure you make use of to establish your company sole proprietorship, partnership, LLC, company or co-op affects your tax obligations, responsibility and coverage demands.

CPAs can prepare tax files, file tax returns, and also plan means to decrease your tax obligation liability for the following year. Also, CPAs can represent you if the internal revenue service has questions regarding your return or if you or your service are examined, which is an important consideration. Business taxes are different from individual tax obligations; even if you have actually always done your tax obligations on your own, you might wish to hire a certified public accountant if your tax situation is facility.

These are various other methods Certified public accountants can assist you with your tax obligations: CPAs aid you recognize and also abide by tax adjustments. When the tax code changes, such as it did with the Tax Obligation Cuts and Jobs Act, a certified public accountant can assist you understand if and also how the modifications influence your company.

The Single Strategy To Use For Certified Cpa

While you wish to take as numerous deductions as you're entitled to, you also do not want to make suspicious deductions that might trigger an audit. A certified public accountant can help you decide when you must or shouldn't take particular deductions - accounting fresno. These are some instances when you could need a certified public accountant's guidance: You're starting an organization see this page and require to recognize which startup prices are insurance deductible.

Your residence and also tiny business intermingle, and also you're not certain which expenditures are insurance deductible. If your lorry is primarily utilized for work, should you or your company own it? !? As you run your company, there may be particular instances when you require a Certified public accountant's proficiency.

CPAs have experience handling the internal revenue service and can help you react suitably, provide the info it needs, and also settle the concern as painlessly as possible. These are some other situations that might prompt you to hire a CERTIFIED PUBLIC ACCOUNTANT: If you're thinking of securing a tiny business lending, a CPA can aid you make a decision if financing fits your long-term goals.

Report this wiki page